ERP

ERP Accounting: Definition, features & benefits for companies

Contents

What is accounting ERP software?

ERP is defined as an integrated management system that centralizes and processes a company’s accounting activities. It is designed to help companies manage their financial activities, including transactions, invoices, payments, budgets, reporting and analysis.

The functionalities of ERP software can vary according to the specific needs of each company, but typically include modules for general, customer, and supplier accounting, budget control, and cash management. The aim of ERP software is to facilitate and streamline processes in order to provide company management with accurate and up-to-date financial information to help them make informed decisions.

What are the challenges and specifics of finance and accounting in ERP?

Finance and accounting play a key role in company management, and their integration into an ERP (Enterprise Resource Planning) system is essential to ensure efficient and accurate control of financial operations. Here are just some of the challenges and specifics:

What are the functionalities of an accounting ERP?

The functionalities of an accounting ERP or an ERP for industry in general can vary according to the specific needs of each company, but they generally include the following modules:

General accounting:

This module allows you to manage G/L accounts, enter accounting entries, edit financial statements, track cash flow, and generate financial reports.

Accounts receivable:

Allows you to control accounts, track invoices and payments, manage outstanding amounts, and generate payment reminders.

Accounts payable:

Allows you to manage supplier accounts, track invoices and payments, manage outstanding amounts, and transmit payment orders.

Cash management:

Allows you to monitor company cash flows, manage bank accounts, generate cash forecasts, and manage foreign exchange transactions.

Budget control:

Allows you to control company budgets, track expenses and revenues, generate budget analysis reports, and make decisions accordingly.

Fixed asset management:

Allows you to manage company assets, track their value, manage depreciation, and generate fixed asset analysis reports.

VAT management:

Allows you to manage the company's VAT obligations, generate tax returns, and check their compliance.

Expense reports management:

Manage employee expense reports, track expenses, and provide reimbursement reports.

Audit and control management:

Allows you to monitor audits and financial controls, generate compliance reports, and take corrective action if necessary.

Reporting and analysis:

Enables you to generate reports, analyze financial data, track key performance indicators (KPIs) and make decisions accordingly.

What are the benefits of using an ERP solution for your accounting?

The benefits of ERP for companies are as follows:

Data centralization:

An ERP solution centralizes all the company’s financial possibilities in one place, making them easier to manage and process.

Process automation:

These types of software feature solutions that automate tasks such as recording entries, checking customer and supplier invoices, monitoring work-in-progress and payments, and so on, reduce errors and repetitive activities, and save time on low value-added projects.

Improved productivity:

By reducing manual tasks and errors, an ERP helps to improve the productivity of teams, allowing them to concentrate on higher value-added actions.

Real-time tracking:

This offers a real-time view of the company’s financial data, making it possible to keep a close eye on the company’s financial situation and react quickly if necessary.

Improved decision-making:

With a comprehensive and accurate view of financial tools, decision-makers can make informed decisions on financial strategy, investment, risk management, etc.

Compliance:

ERPs include functionalities that enable compliance with current accounting and tax standards, making it easier to meet legal obligations.

Better communication:

They facilitate communication between different teams within the company, providing a shared, global view of financial data.

What’s the difference between an accounting ERP and accounting software?

Accounting software is an IT solution designed to help companies manage their figures and costs, by automating accounting services such as recording of journal entries, invoice management, expense accounting, etc. Accounting software is often designed for SMEs, and can be used on a stand-alone basis.

An accounting ERP, on the other hand, is a more complex system for managing all company activities, including financial aspects. ERP systems comprise several functional modules (finance, purchasing, sales, inventory, sales, production, etc.) which communicate with each other. This ensures centralized control of all company data. These solutions are generally designed for medium-sized or large companies, and can be customized to meet specific business needs. For example, you can choose a Cloud-connected ERP or one hosted on your own servers.

In short, the main difference between accounting software and accounting ERP lies in functional coverage. Whereas accounting software focuses solely on accounting tasks, an ERP covers all business processes.

How to choose the right accounting ERP software for your SME?

Installing an ERP for your SME is an important decision that can have a significant impact on the management of your business. Here are a few key points to consider:

Functionality

Make sure the software offers all the solutions required to meet your company's specific accounting, production and management needs. Also check that the software is scalable and can adapt to future changes.

Integration

Check whether the platform can be easily implemented with other systems you already use in your company, such as payroll systems, inventory control systems, etc.

Ease of use

ERP must be easy to use for the employees who will be using it. Make sure that the user interface is intuitive and that activities can be performed easily.

Technical support

Make sure the supplier offers quality technical support and can provide assistance in the event of a problem or question.

Security

The tool must be secure, and your company's data must be protected against cyber-attacks and breaches.

User comments and ratings

Consult comments and ratings from current users to get an idea of customer satisfaction and overall software quality.

An ERP is different from a CRM in that it offers much more comprehensive functionality. This type of software is composed directly of CRM functionality.

Why choose Axelor ERP for your accounting?

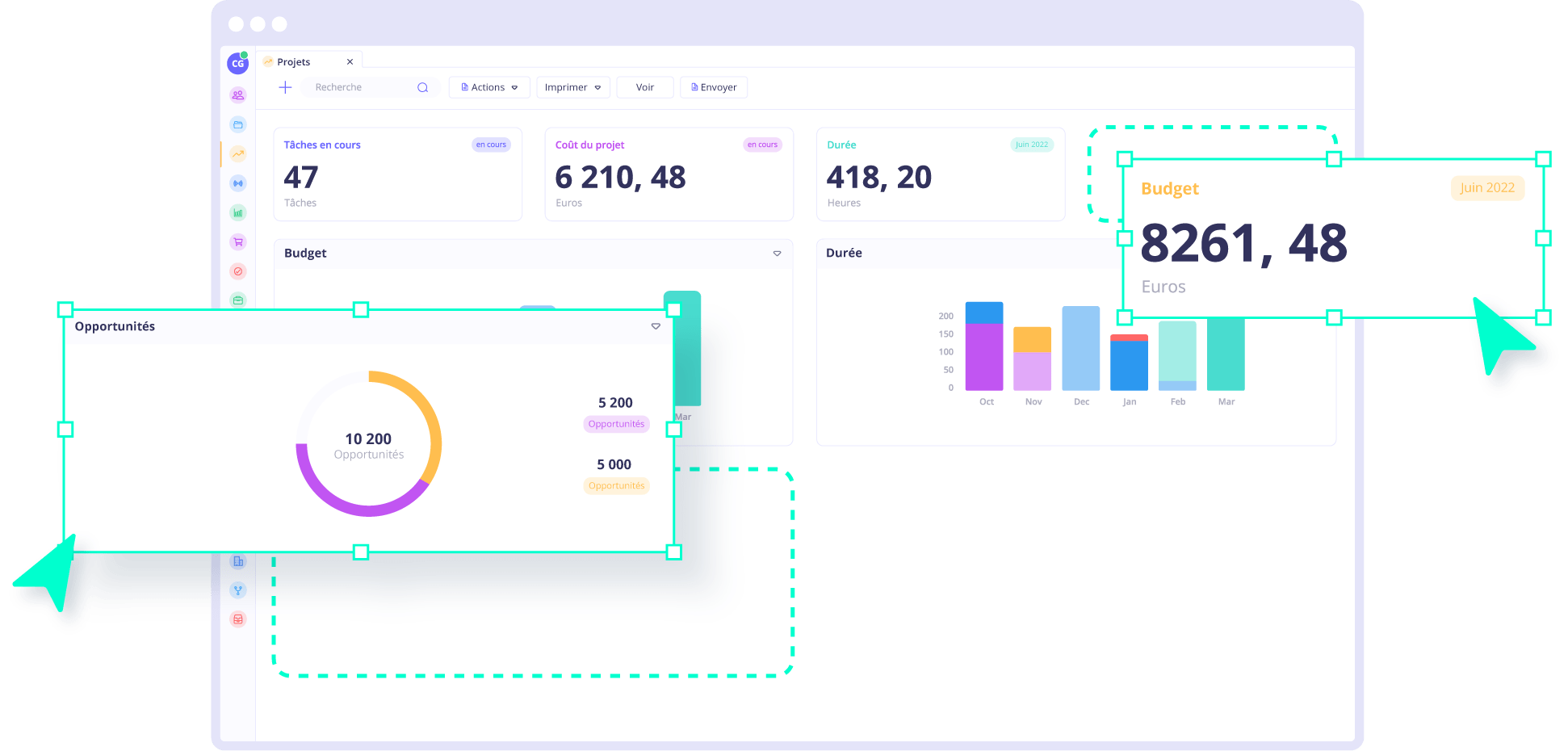

Benefit from truly integrated accounting with Axelor. On our Open Source ERP, the analytical application automatically generates accounting entries from pre-parameterized documents and templates, and allows you to enter various operations in an assisted way. You benefit from a lettering system, which can even be partial.

The accounting software lets you manage cost-accounting entries, with native management of cost breakdowns by third party or by product. Real-time accounting reports are just a few clicks away: general ledger, balance, remittance slip, journals, VAT, etc.

Scheduling of accounting periods is configurable by company, as is journal and chart of accounts management. In addition to automatic tax control, you can customize tax positions based on transactions.

Thanks to our advanced collection functionality, which enables you to define reminder rules according to customer type, you can automate the type of reminder you wish to send to your customer. You can also define the time limit for exceeding the payment deadline.

Bank reconciliation between bank statement lines and accounting entries is automatic. SEPA direct debit and credit transfer processing is fully automated, including the handling of bank or cheque rejects.

You can manage overpayments according to minimum threshold rules. You can also manage bad debts, payment discrepancies, and doubtful debts via the accounting module.

Axelor also supports EBICS TS, enabling you to exchange any type of file with your bank, with no volume limits. Axelor gives you all the keys you need to succeed with your ERP specifications, and can offer you other resources such as inventory management.

Find out how our ERP can help you improve your company’s performance

An expert will contact you shortly to discuss your project.